only $900 instead of the original $1,000. would acknowledge the returned goods and the reduction in the amount receivable by issuing a credit memo to ABC Ltd. The debit memo might look something like this: Debit Memoĭescription: 10 units returned, $10/unitĪBC Ltd. To document this return and the corresponding reduction in the amount payable, ABC Ltd.

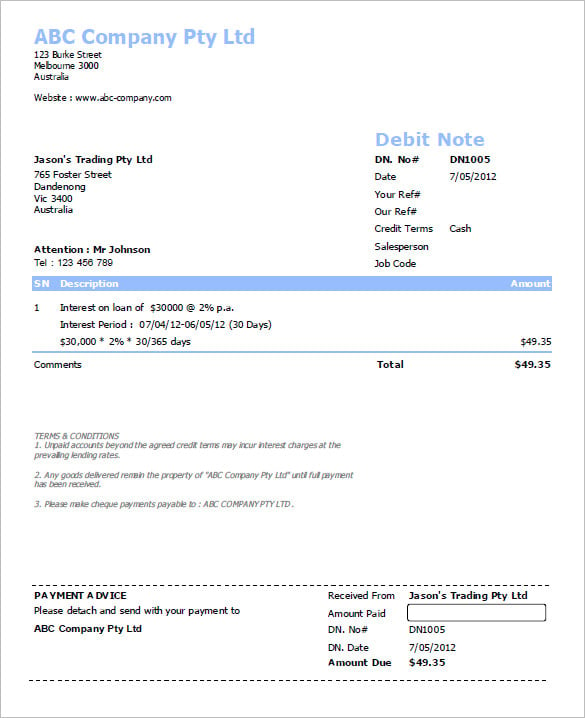

finds that 10 units are defective and decides to return these to XYZ Inc. Suppose a company, ABC Ltd., purchases 100 units of a product from its supplier, XYZ Inc., at $10 per unit. It’s worth noting that the term “debit memo” can also refer to an internal document used by a bank when it needs to adjust a customer’s account downwards for some reason, such as a service charge or a loan payment. The seller, upon receiving the debit memo, would typically issue a credit memo to acknowledge the reduction in the amount receivable. If you see a debit memo entry in the transaction details of your transaction history, the amount indicated in the amount column next to this entry has been debited from that account. In all these cases, the debit memo serves as the buyer’s record of the reduction in the amount owed. Early Payment Discounts: If the seller offers discounts for early payment, and the buyer takes advantage of this offer, a debit memo can document the discount.Analyze the root causes of Agency Debit Memos (. Overcharges: The seller may have made an error in the original invoice, such as charging too much for a product or service. A credit memo is a contraction of the term 'credit memorandum,' which is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice. IATA Agency Debit Memo (ADM) Prevention Workshop aviation training course.It is generally used as an adjustment process when there is an underbilled transaction in the business. The debit memo reduces the buyer’s payable balance by the value of the returned or rejected items. Debit Memo is a document used in a business-business transaction.

The adjustments made to the account reduce the funds in the account but are made for specific purposes and used only for adjustments outside of any normal debits. Returns or Rejections: The buyer may return goods or reject services that were previously billed. A debit memorandum, or debit memo, is a document that records and notifies a customer of debit adjustments made to their individual bank account.A debit memo, also known as a debit memorandum, is a document that a buyer issues to a seller, indicating a reduction in the amount that the buyer owes to the seller under the terms of an earlier invoice.ĭebit memos are commonly used in B2B transactions and may be issued for several reasons:

0 kommentar(er)

0 kommentar(er)